One benefit to autocorrelation is that we can identify patterns within the time series, which helps in determining seasonality, the tendency for patterns to repeat at periodic frequencies. Lags are very useful in time series analysis because of a phenomenon called autocorrelation, which is a tendency for the values within a time series to be correlated with previous copies of itself. The picture below illustrates the lag operation for lags 1 and 2. The lags can be shifted any number of units, which simply controls the length of the backshift. The lag operator (also known as backshift operator) is a function that shifts (offsets) a time series such that the “lagged” values are aligned with the actual time series. Labs(title = "tidyverse packages: Daily downloads", x = "",Ĭaption = "Downloads data courtesy of cranlogs package") + Ggplot(aes(x = date, y = count, color = package)) +įacet_wrap(~ package, ncol = 3, scale = "free_y") + We can visualize daily downloads, but detecting the trend is quite difficult due to noise in the data. Tidyverse_downloads # A tibble: 1,629 x 3 # tidyverse packages (see my laptop stickers from first post) ) The script below gets the package downloads for the first half of 2017.

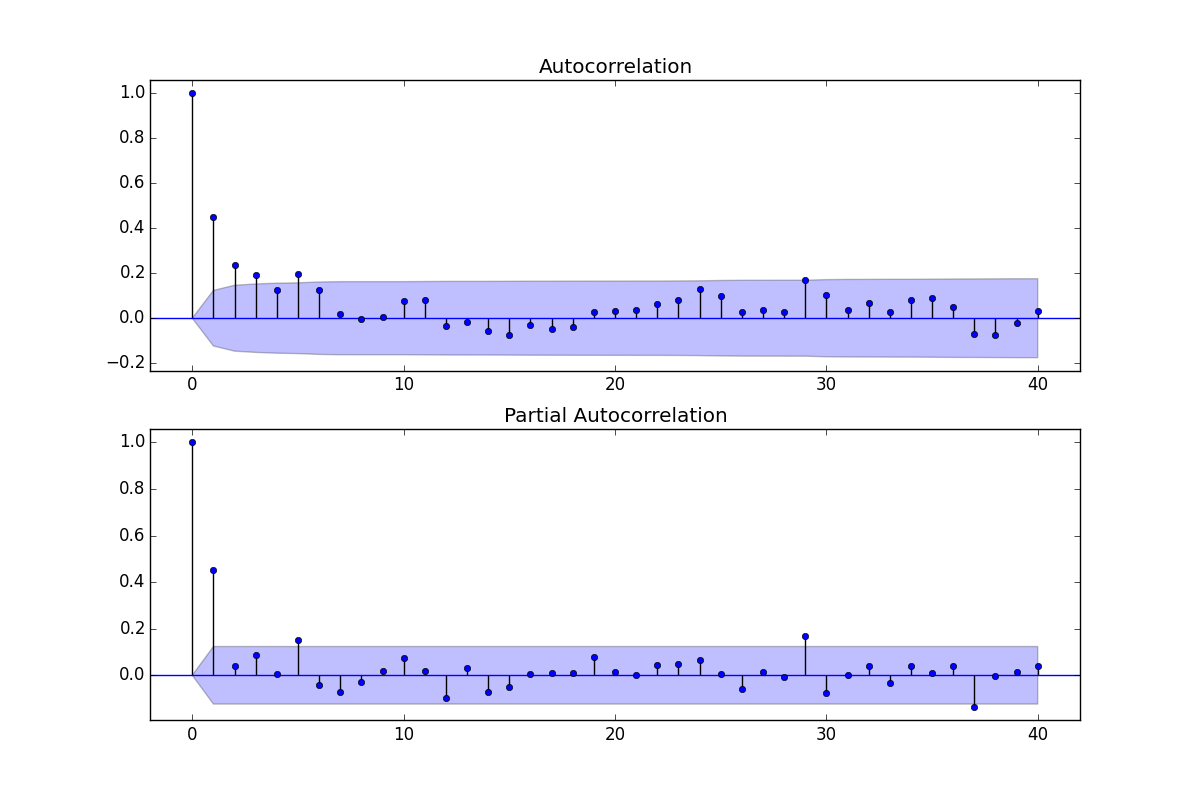

We’ll be using the same “tidyverse” dataset as the last several posts. Library(forcats) # Working with factors/categorical data CRAN tidyverse Downloads Library(timetk) # For consistent time series coercion functions Library(cranlogs) # For inspecting package downloads over time library(tidyquant) # Loads tidyverse, tidyquant, financial pkgs, xts/zoo We’ll need to load several libraries today. Here’s an example of the autocorrelation plot we investigate as part of this post: If you haven’t checked out the previous tidy time series posts, you may want to review them to get up to speed. If you like what you read, please follow us on social media to stay up on the latest Business Science news, events and information! As always, we are interested in both expanding our network of data scientists and seeking new clients interested in applying data science to business and finance. When using lag.xts() with tq_mutate() we can scale to multiple groups (different tidyverse packages in our case). The focus of this post is using lag.xts(), a function capable of returning multiple lags from a xts object, to investigate autocorrelation in lags among the daily tidyverse package downloads. We’ll use the tidyquant package along with our tidyverse downloads data obtained from cranlogs. In the fourth part in a series on Tidy Time Series Analysis, we’ll investigate lags and autocorrelation, which are useful in understanding seasonality and form the basis for autoregressive forecast models such as AR, ARMA, ARIMA, SARIMA (basically any forecast model with “AR” in the acronym).

0 kommentar(er)

0 kommentar(er)